Stick to analysing and discussing the IEADs — that is the Income, Expenses, Assets & Debts — with your business clients if you want to keep it simple, said Precious Mvulane from GAD Consulting Services on the recent episode of the IBASA & EPI Webinar Series. She was one of the panelists, along with IBASA Chair, Tumelo Tsotetsi, on the CPD theme covering practical considerations in conducting financial analysis of small business client performance.

<< VIEW THE EVENT RECORDING HERE >>

Financial analysis is an obvious topic and logical part of assisting a small business in improving their results, for the attendees of this CPD webinar, proven by 96% indicating in a poll that financial analysis was essential or very important in the assistance of their clients.

However, business advisors are challenged on two levels when supporting their small business clients in using financial information:

- Firstly, small business owners are often not really interested in the financial administration and management, leaving it to their accountants to manage.

- And secondly, many business advisers do not have an accounting background or the needed skill and experience to make financial analysis accessible for their clients.

Precious reiterated that business advisors are not necessarily accountants themselves but says that as they are building and working with entrepreneurs, they should be learning how to use financial analysis to help their clients.

An accessible approach, said Precious, is to reduce business finance to just four elements, namely:

- Income – the sales, interest, dividends and professional fees that are generated in a business.

- Expenses – the money spent to run the business.

- Assets – what the business owns.

- Debt – what the business owes others.

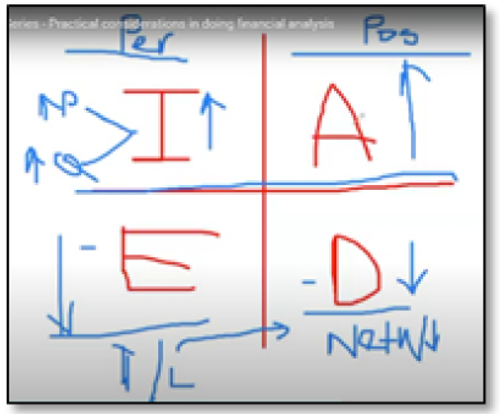

No matter whether the business is a listed company in Hong Kong or New York, or a spaza shop in Soweto, or a side hustle, the only thing that you do within finance is within these four elements, she says. The relationship between these four elements can be presented by drawing two lines, forming a cross, with Income and Assets at the top; and Expenses and Debt at the bottom.

During the webinar she used a whiteboard to explain the relationship between four elements (see the video recording of the four elements here). The left side is about managing current performance, while the right side is about the overall strength of the business. On the left, Income, less Expenses, results in a profit or loss; while on the right side, Asset less Debt, reflects the net worth or current value of the business.

Clearly, the net worth of the business is highly affected by the profitability of the business. If you keep on making losses, the net worth automatically reduces the value of that business, which the accountants call shareholders equity.

Some questions about these four elements may be useful for business advisors to explore with their clients:

- How much money am I making now compared to what I’ve been making and what is causing the difference?

- How much am I spending now compared to the past and am I making a profit or loss?

- How much assets do I own and are these assists making money for me?

- How much do I owe other people and how can I reduce this over time?

Precious stressed the importance of understanding the next two points:

Precious stressed the importance of understanding the next two points:

- You need to make sure that everything that is above the horizontal line is kept high at all times — that is Income and Assets.

- Everything that is below the horizontal line must be kept low at all times — that is Expenses and Debt.

“Guys, that’s your financial statements”, she exclaimed.

If you want guaranteed profit, you do these two things, keep everything that is above the line high, and keep everything below the line low. This very simple way of explaining finances makes it very easy for business owners to understand their finances.

Advisers can guide their clients to consistently look and measure this as they’re running their businesses day today. From this, advisors can build up more information, challenging their clients with questions such as: “Having identified your best sellers, tell me something in those areas about your income. Should you be increasing the price, or should you be increasing the quantity? Or, should you be diversifying?”

On the whiteboard Precious drew orange arrows, to provide another perspective to interrogate with the client. First, is how Income relates to assets? She emphasised talking about producing Income because if your client has an Asset and is not producing Income, they should consider the idea of disposing that Asset.

On the whiteboard Precious drew orange arrows, to provide another perspective to interrogate with the client. First, is how Income relates to assets? She emphasised talking about producing Income because if your client has an Asset and is not producing Income, they should consider the idea of disposing that Asset.

Another question is the amount spent to generate the Income. She refers to the matching principle where the Income generated should also be matching with the Expenses. Precious said she has seen businesses where the Income is not talking to the Expenses because matching is not done. The problem when matching is not done, there is a chance that you are under-pricing, because you have not accounted for all your costs.

Also, important to ask is how the Expenditure is being financed? Is it financed by external parties? In which case, is it through suppliers, with a bank overdraft, or is it your shareholders?

Precious admits that some accountants might say she missed the Cash Flow. “No, she says, I’m not missing the Cash Flow. Let me explain. So, the left side is an Income Statement. The right is the Balance Sheet. The movement between Income Statements, which reflects performance, and the Balance Sheet is Cash Flow.

During the webinar Tumelo introduced the attendees to key concepts that give meaning to financial management and the different uses of financial information. He emphasised the importance of keeping accurate and timely prepared financial statements; and highlighted a few key indicators available to business advisors in early detections of business health, such as top line income trends, the profitability of the business and the key ratios of EBITDA (Earnings Before Interest, Tax, Depreciation and Amortisation) as well as the Gross Profit Margin. The one indicating the profit out of operations and the other helpful with quickly calculating break-even and the impact of discounts. The aim, he said, is to keep the GP margin as stable as possible.

Looking at the health of the financial position of the business, indicators like solvency, owner’s loan and cash flow are deemed fundamental. Key financial ratios Tumelo highlighted are gearing (own versus borrowed funds) and liquidity (ability to pay your debts).

Tumelo felt strongly that business advisers should assist entrepreneurs to create realistic cash flow projections, aiming to achieve a net cash surplus, but ensure that the assumptions are reasonable. He also says that practitioners need to be mindful about their client’s status regarding personal surety provided, their banking conduct and ICT profile / judgements, that could all impact on the possibilities to assist the business.

-

The new IBASA MD, Mpho Mofikoe, was also introduced to members during this webinar, which was hosted by Christoff Oosthuysen of the Entrepreneurial Planning Institute.

-

Carel Venter is a partner in the Entrepreneurial Planning Institute (EPI) and producer of the IBASA & EPI Webinar Series.

-

Watch the webinar replay << here >>.